12 Great Depression-Era Secrets for Stretching Every Last Dollar

Some weeks, your paycheck feels like it evaporates the moment it lands, and suddenly every expense demands a little extra thought. So when your income shrinks or prices climb overnight, the way you treat each dollar matters more than ever.

Luckily, people all over the country are testing out resourceful ways to cover essentials and still breathe easily. These ideas come straight from real habits that actually work. Let’s explore them.

Stabilize Your Core Expenses

Credit: Getty Images

Think of your money like a triage chart. Rent, food, and medication go to the top, then everything else waits its turn. A 50/30/20 split helps many people carve out breathing room. Knowing which costs must stay covered keeps you from panicking when unexpected gaps appear in income.

Automate Transfers and Payments

Credit: Getty Images

Shifting money automatically keeps your plans on track without relying on memory. Schedule a modest transfer into savings each payday and set up auto-pay for bills to avoid late fees. Small recurring deposits build momentum and prevent sudden cash crunches when unexpected expenses hit.

Use High-Yield Savings Accounts

Credit: Canva

Parking money in accounts earning over 4% interest can turn idle cash into steady growth. Even a few dollars a week can add up over months. This cushion can catch you when work hours are cut or a surprise repair comes along.

Prioritize Expensive Debt First

Credit: pexels

If your credit card interest is sky-high, that’s where your extra money should go. Chip away at the card with the steepest rate before worrying about smaller debts. Whether you prefer to see fast progress or want the math to work out in your favor, shrinking that expensive balance is what actually helps your budget.

Negotiate With Lenders

Credit: Getty Images

A short phone call sometimes saves far more than a week of penny‑pinching. Credit card companies, utilities, and even internet providers often have hardship programs. Asking for a lower rate or a fee adjustment may not always work, but when it does, the breathing space feels immediate and significant.

Track Spending Honestly

Credit: Canva

Budget apps or simple spreadsheets can reveal where money leaks out unnoticed. Spotting recurring charges or frequent small purchases helps cut waste without overhauling your lifestyle.

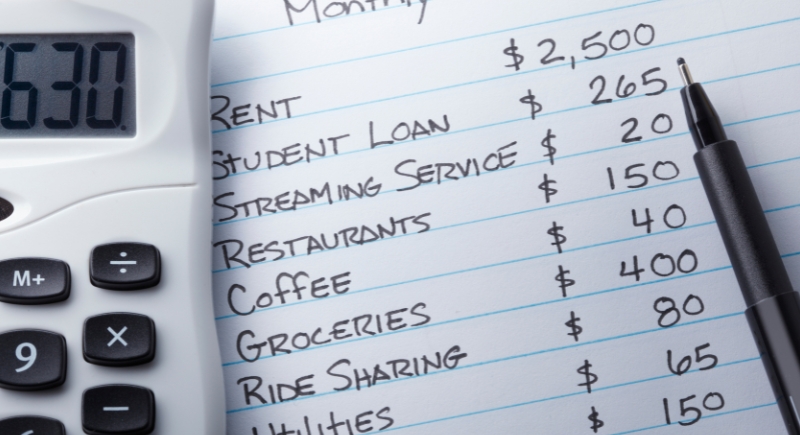

Rework Your Monthly Budget

Credit: Getty Images

A rigid plan falls apart the moment life throws in car registration or back-to-school expenses. Building a slightly different budget each month gives you foresight. This approach helps keep those irregular hits from eating into rent or groceries, because you’ve factored them into the mix beforehand.

Cut Restaurant Spending

Credit: Getty Images

Cooking at home saves far more than many realize. Redirecting funds from takeout into groceries and simple meal plans can free hundreds each month. Some families set rules like home-cooked dinners on weekdays and only one restaurant outing a week to strike a balance.

Limit Retail Therapy and Impulse Buys

Credit: Canva

A thirty-minute pause before hitting “buy” has stopped countless unneeded packages from arriving. Some people use local swap groups to trade items they no longer use. The financial relief comes without feeling like you’ve given something up.

Adopt Minimalist Habits

Credit: Canva

Fewer possessions mean less cleaning, less repairing, and fewer replacements down the line. Many practice a “one in, one out” approach when tempted by new purchases, and over time, the habit grows stronger. The result is a home that feels lighter and costs that steadily shrink in unexpected ways.

Earn Through Side Gigs That Fit You

Credit: Getty Images

Housecleaning, childcare, or delivering groceries can provide predictable income when your main job feels uncertain. Regular clients or app-based gigs let you scale hours up or down. Many find these services reliable because they address ongoing, everyday needs in their communities.

Tap Into Online Freelancing

Credit: Canva

Freelance platforms connect people with skills to those willing to pay for them. A knack for data entry, writing product descriptions, or light graphic design can turn evenings into extra income. It might take some time, but it will help you take higher-paying projects later.

Sell Handmade or Resell Items

Credit: Canva

Jewelry makers, thrift resellers, and crafters use marketplaces like Etsy or eBay to reach buyers. These ventures often start small, with weekend efforts turning unused items or hobbies into a steady trickle of income.

Use Balance Transfers Wisely

Credit: Canva

A 0% interest offer can buy you time, but only if you treat it as a temporary tool. Move high-interest debt there, then focus on shrinking the balance before the clock runs out. Combined with a bit of side income, this method trims interest charges noticeably over time.

Trim Entertainment Costs

Credit: Getty Images

Many households rotate streaming subscriptions or use library resources to cut back on costs. If you have slower months, you can swap three services for one to free up cash without ending movie nights or weekend reading.