12 Safe Retirement Ideas for Seniors Outside of the Stock Market

Retirement should be secure, not stressful. Yet with today’s market swings, many seniors wonder where true peace of mind lies. There are still time-tested ways to protect your future without riding the ups and downs of Wall Street. Let’s explore smarter, safer paths to lasting financial confidence.

High-yield savings accounts

Credit: iStockphoto

It’s satisfying to watch your finances grow slowly but surely, without lifting a finger or breaking a sweat. High-yield savings accounts are one of the safest retirement ideas that offer higher interest than traditional banks while keeping your cash easily accessible.

Certificates of deposit (CDs)

Credit: Getty Images

A certificate of deposit lets you lock in a specific interest rate for a set time. Your deposit is federally insured, and rates don’t change for the term you choose. Typically, longer terms offer better returns, but you’ll pay a penalty if you withdraw early.

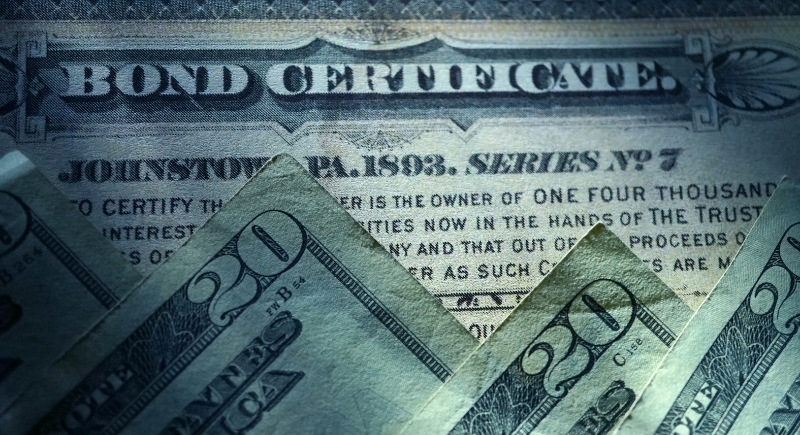

Treasury bonds

Credit: Getty Images

Some things still carry the weight of solid government backing, and Treasury bonds are proudly in that club. These are safe retirement ideas, backed by the public treasury itself, and pay steady interest until maturity.

Municipal bonds

Credit: Getty Images

Local governments raise money by selling municipal bonds. Investors buy these bonds and receive interest, which is often exempt from federal taxes. Proceeds typically fund schools, roads, or other public projects. Many retirees like municipal bonds for the steady payouts and tax breaks. The risk of default is low but not zero, depending on the issuer.

Fixed annuities

Credit: Getty Images

Fixed annuities are designed to pay out steady income with no surprises attached. Insurance companies handle the details; you collect the checks. It’s like having a personal pension without the office drama, paperwork, or awkward retirement party.

Real estate rental income

Credit: Getty Images

Rental properties offer one of those prudent recession projects where an investment works for you, not the other way around. Tenants and well-chosen locations can turn houses into dependable income machines and pay you year after year.

Reverse mortgages

Credit: Canva

Your home’s been working hard for decades, so why not let it return the favor? Payments come to you, tax-free, while you stay put. Reverse mortgages are popular for turning home equity into cash flow without selling. It’s financial breathing room, designed for homeowners who’ve already earned it.

Precious metals (gold, silver)

Credit: Getty Images

Gold and silver are physical assets you can buy and store. They don’t produce income or dividends, but many people hold them as a hedge against inflation and economic uncertainty. Prices can swing, but gold and silver remain a popular option for anyone looking to diversify beyond cash or stocks.

Peer-to-peer lending

Credit: Getty Images

Lending money to others might sound risky, but platforms today make it straightforward. Peer-to-peer lending connects retirees with vetted borrowers, which helps them earn interest without involving banks. It’s a modern twist on old-fashioned lending, where your extra cash generates returns while someone else builds their dream.

Life insurance with cash value

Credit: Getty Images

Some permanent life insurance policies, like whole and universal life, let you build cash value over time. This balance grows tax-deferred and can be borrowed against or withdrawn, often with limits or fees. The cash value is separate from the death benefit and is accessible while the policyholder is still living.

U.S. savings bonds

Credit: iStockphoto

Slow and steady still has a place at the table. U.S. savings bonds, backed by the federal government, earn interest safely over time while protecting your principal. They’re an old-school choice for retirees who prefer simplicity over speculation. Sometimes, the tried-and-true path leads straight to financial peace of mind.

Farmland investments

Credit: iStockphoto

Farmland can be bought outright or accessed through agricultural REITs. Landowners collect rent from farmers or share in crop profits. Values tend to reflect local yields, commodity prices, and water rights. While land is less liquid than stocks, farmland has historically held up well during inflation and market downturns.

Private lending with collateral

Credit: Canva

Think of this like being the bank, but smarter. Private lending secured by collateral means you loan finances with assets backing it up—cars, property, or other valuables. It’s one way to earn interest while reducing risk. Pensioners often appreciate the clarity: money out, money back, with security attached.

Structured settlements

Credit: Getty Images

Settlements from lawsuits or insurance claims don’t always arrive in one big check. Structured settlements pay in predictable installments and provide income over time. Many golden-agers purchase them for guaranteed cash flow. It’s not flashy, but knowing exactly when and how much you’ll receive is a kind of luxury.

Collectible assets

Credit: Canva

Collectibles—art, coins, vintage cars, or antiques—can gain value but aren’t easy to sell quickly. Their prices depend on demand, rarity, and condition. IRS taxes profit from collectibles at a higher rate than most other investments. Most experts consider them speculative since values can rise or fall sharply.