10 Ways Economists Know A Recession Is Coming

Recessions often come with signs we don’t immediately think about. These unexpected indicators are things like lipstick sales, diaper rash, and even snack habits. Economists sometimes look at these quirky indicators to gauge the state of the economy. Here are 20 interesting ways these experts may predict an impending recession.

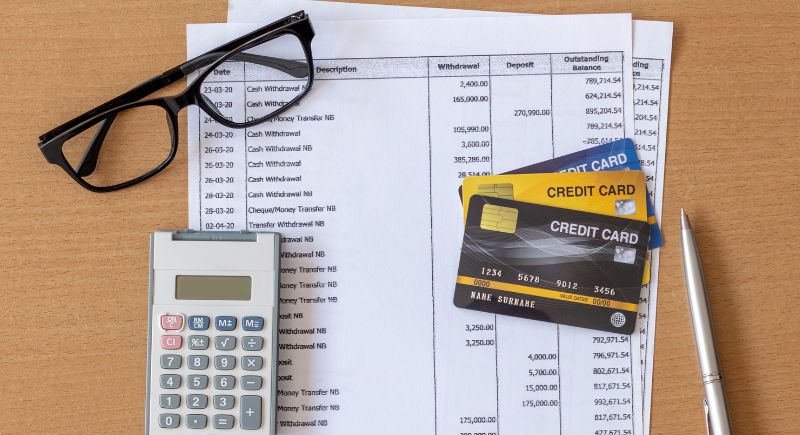

Credit Card Debt Increases as Consumers Struggle

Credit: Getty Images

An increase in credit card debt is a clear signal that people are relying more on borrowed money to cover everyday expenses. As the economy tightens, credit card usage tends to rise, reflecting consumers’ struggle to maintain their lifestyle during uncertain times. When debt levels spike, it’s a warning sign of a potential recession.

Pet Snack Sales Drop with Economic Worry

Credit: Wikipedia

Just as with human snacks, pet snacks can serve as a sign of economic health. General Mills, the maker of Chex Mix, reported a decline in pet snack sales, suggesting that consumers are tightening their budgets. When even pets’ treats are cut back, it could be a sign that the economy is in trouble.

Home Improvement Spending Slows in Tough Times

Credit: Getty Images

Home improvement sales can reveal a lot about the economy. In prosperous times, homeowners are more likely to invest in renovations. When a recession is on the horizon, spending on non-essential improvements slows down. People hold off on upgrades and repairs, prioritizing savings instead, which signals economic worry.

Champagne Sales Fall During Recessions

Credit: pixelshot

The Champagne Index follows the inverse of the Lipstick Index. During hard times, people often cut back on luxury items, such as champagne. For example, U.S. Champagne sales plummeted in 2009, but bounced back by 2021 as social gatherings returned. A dip in bubbly purchases may be a sign of a recession.

The Stripper Index: Tips Decline When Money Gets Tight

Credit: Getty Images

If tips fall, it is often an indicator of an economic contraction. It might sound unconventional, but the Stripper Index holds some truth. When consumers are struggling financially, discretionary spending on entertainment, including tipping exotic dancers, tends to decline. The theory has been applied more broadly to other service workers.

Lipstick Sales Increase as Consumers Cut Back

Credit: Canva

Leonard Lauder first observed this in 2001: when the economy dips, lipstick sales go up. Lipstick is a small, inexpensive luxury that people can still indulge in during tough times. This trend held during the 2008 recession and has resurfaced, with beauty products thriving even as inflation runs high.

Fast Food Visits Rise with Tight Budgets

Credit: Getty Images

During financial stress, people tend to eat out less at expensive restaurants and more at fast-food chains. A decline in full-service dining, paired with a rise in fast food, could indicate a recession. Fast food is cheap, convenient, and a comfort during times of financial uncertainty.

Supermarket Trends Reflect Budget-Friendly Shopping

Credit: Canva

Shoppers tend to gravitate toward budget-friendly options when a recession is looming. The “bigger cart, smaller item” trend kicks in, meaning people buy more basic, low-cost goods. This shift is often reflected in supermarket sales data, where cheaper brands and bulk items see a rise as consumers stretch their dollars.

T-shirt Sales Drop as Discretionary Spending Falls

Credit: Getty Images

T-shirt sales may not seem important, but they’re another way to gauge the economy. During hard times, consumers often hold off on buying non-essential clothing. When T-shirt sales drop, it suggests that people are cutting back on discretionary spending, signaling possible economic trouble on the horizon.

Wedding Industry Shrinks During Economic Downturns

Credit: pexels

The wedding industry can also be a sign of economic shifts. When people start postponing or scaling down their weddings, it suggests that they are cutting back on substantial expenditures. In times of economic stress, couples often trim down their celebrations, which can be a subtle yet telling sign of an impending downturn.

Cardboard Box Sales Decline with Consumer Spending

Credit: Canva

Cardboard boxes are essential in transporting goods, so when demand for them drops, it’s a sign that consumers are buying less. In the 2008 recession, cardboard shipments fell drastically, signaling a broader economic slowdown. A similar dip in 2023 suggests that we might be heading into another downturn.

Mini Alcohol Bottles Become Popular in Recessions

Credit: pexels

Instead of splurging on full bottles, some consumers turn to mini-sized bottles of alcohol. This trend is particularly evident in hard liquor, with companies like Brown-Forman reporting a rise in small-bottle purchases. When wallets are tight, people still want to drink, but in smaller, more affordable portions.

Fashion Sales Shift to Discounted Items

Credit: Wikimedia Commons

When people start flocking to sales, especially during times of economic uncertainty, it indicates a shift in spending habits. Discounted fashion items experience a surge in demand as people start to prioritize their savings. A rise in the popularity of sales events can often suggest that consumers are tightening their belts.

Small Cars Become Popular During Financial Strain

Credit: Wikimedia Commons

When times are tough, people tend to trade in their flashy vehicles for smaller, more economical ones. The theory is that buyers opt for smaller cars when they need to conserve cash. Car sales data often reflect a shift toward budget-friendly options, which economists interpret as a sign of economic strain.

Tech Gadget Sales Drop as Luxury Purchases Cut

Credit: dotshock

Technology gadgets are often the first big-ticket items people give up when times get tough. Whether it’s the latest smartphone or gaming console, tech sales dip during a recession. As consumers cut back on luxury and non-essential purchases, gadgets become a sacrifice to preserve financial stability.