How Crippling Financial Anxiety Is Leading Gen Z to ‘Bed Rotting’

Gen Z is exhausted, and money is at the heart of it. Federal Reserve Chair Jerome Powell has acknowledged that young workers are struggling, and surveys indicate that nearly 70% of Gen Z members report that financial stress is disrupting their sleep.

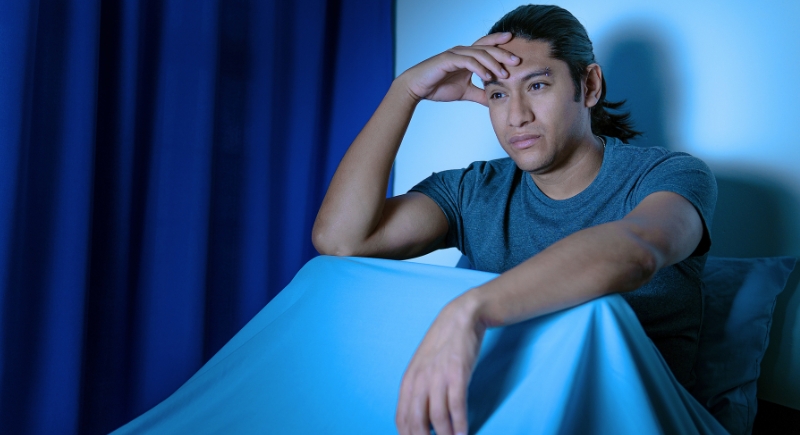

Instead of getting rest, they lie in bed with their phones, scrolling endlessly, and, in many cases, succumbing to “bed rotting,” a trend where hours are spent under the covers to escape reality.

Sleepless Nights Fueled by Money Worries

Image via Canva/Alfred Hernández Ríos

An Amerisleep survey revealed that 49% of Americans lose sleep over finances, but Gen Z is clearly hit the hardest. Around 47% say their sleep has gotten worse since 2025 began; they often wake up in the middle of the night due to financial anxiety. About 1 in 10 Americans average fewer than five hours of sleep, with that number climbing higher for those who check their bank accounts before bed.

The financial pressure is undeniable. Around 63% of Gen Z report running out of money by the end of the month. Nearly half still rely on their families to cover essentials like rent and groceries. Student debt remains a major burden for young people.

The Rise of Bed Rotting and Doomscrolling

Instead of turning to financial planning, many are leaning on avoidance. Surveys show 37% of Gen Zers admit to bed rotting, while more than half scroll social media or binge-watch TV to ease their minds. While it may feel like a break, experts say these habits create a cycle where stress and fatigue perpetuate each other. Blue light from screens disrupts sleep rhythms, and exposure to constant economic news only makes things worse.

To be clear, this is a coping mechanism. Even so, the problem is that once the scrolling ends, the same money worries come rushing back, and the exhaustion deepens.

Small Steps That Can Help

Image via Pexels/Miriam Alonso

Experts suggest replacing avoidance with structured routines. One tool is a “worry window,” where you dedicate 15–20 minutes earlier in the day to write down concerns and possible solutions. When those thoughts come back at midnight, you can remind yourself they’ve already been addressed. Sleep specialists also recommend a phone curfew before bed, where you leave devices outside the bedroom, and wind down with calming activities like journaling, stretching, or reading a book.

On the financial side, small, steady progress helps. Automating savings, tackling one small debt, or tracking expenses for a month can restore a sense of control. Bank of America’s Better Money Habits study found that 72% of Gen Z are already trying to improve their financial health, with some diversifying income streams or automating savings. Still, only 25% contributed to retirement accounts last year, and 55% lack an emergency fund large enough to cover three months of expenses. Those gaps explain why so much stress lingers despite good intentions.

More Than Just a Generation Problem

Money anxiety for Gen Z is not only about individual choices. Systemic challenges, such as wage stagnation, rising housing costs, and student loan burdens, are major drivers of stress. Social media exacerbates the problem by amplifying consumer pressure and encouraging comparisons to curated online lifestyles that often fail to reflect reality.

Still, there are signs of resilience. Many Gen Z members are increasingly linking financial wellness to overall well-being. That mindset may encourage healthier habits that balance money management and mental health. The challenge now is translating that awareness into consistent actions and getting the sleep needed to handle an economy that rarely gives them a break.