7 Habits That Slowly Drain Your Wallet, According to Experts

You don’t need a big scandal to lose money—most people do it little by little, without even noticing. Financial expert and YouTuber George Kamel has built a following by pointing out exactly where those leaks are happening. These everyday habits drain your wallet behind the scenes, and plugging these holes can make a serious difference.

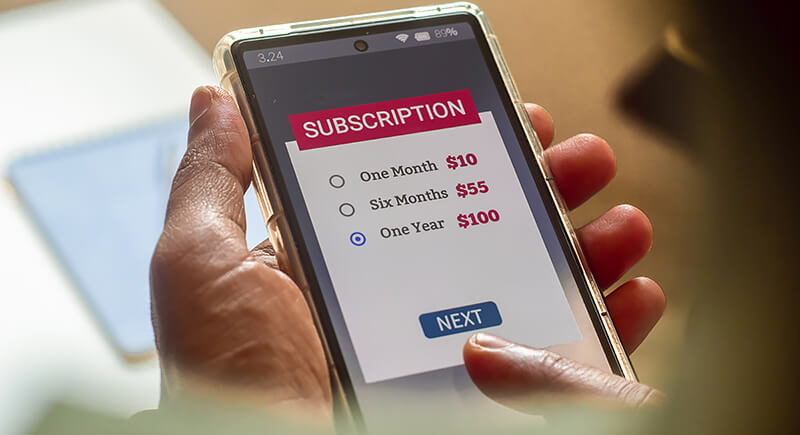

Unused Subscriptions

Credit: iStockphoto

Streaming services, cloud storage, apps—you sign up, forget, and auto-pay monthly. Check your bank and card statements regularly. Even $10 here and there adds up fast. Scrubbing those forgotten subscriptions can free up hundreds each year without changing your lifestyle.

Impulse Purchases

Credit: iStockphoto

Impulse spending is one of the sneakiest ways people bleed money. Next time, try using a 24-hour pause button before making the decision. Because most “must-haves” feel more like “what was I thinking” after a good night’s sleep.

Extended Warranties

Credit: iStockphoto

The pitch sounds sensible: protect your new gadget for just $39.99 more. But Kamel says it’s mostly profit for retailers—and a gamble for you. If the thing breaks, it probably breaks after the coverage expires. If it doesn’t? That cash was just insurance you didn’t need.

Overdraft Fees

Credit: iStockphoto

Here’s how you donate to your bank without meaning to: go one dollar over your balance, get hit with a $35 fee. Do it twice, and you’ve bought them lunch. One solution is to set up low-balance alerts—or better yet, use banks that don’t penalize human error.

Credit Card Interest

Credit: iStockphoto

That $100 dinner could cost you $140 if you just make minimum payments. Interest is the price of impatience—and Kamel wants you to ditch it. If you can’t pay it off in full, it’s not in the budget. Credit cards are tools, not free money.

Unused Gym Memberships

Credit: iStockphoto

The gym key tag lives on your keychain, untouched. You’re paying for good intentions, not actual workouts. It’s time to cut ties if your sneakers haven’t hit the treadmill in weeks. Just switch to something that matches your real-life routine, not your January optimism.

Brand Loyalty

Credit: iStockphoto

You always grab the same detergent, cereal, and toothpaste, without even glancing at the alternatives. That kind of brand autopilot is costing you. Store-brand versions are often made in the same factories. The only real difference is that one makes you feel loyal, the other saves you money.

Ignoring Insurance Reviews

Credit: iStockphoto

Auto, home, life—set it and forget it, right? Not so fast. Try shopping around every year. Rates change, bundles shift, and staying put out of convenience means you’re likely overpaying. Overpaying for loyalty shouldn’t be a thing.

Late Fees

Credit: iStockphoto

Forget a due date, and suddenly your internet bill is $15 higher. These fees are the dumbest kind of debt—completely avoidable. Automation or calendar reminders can save your credit score and your cash. Don’t tip your bill collector for nothing.

ATM Fees

Credit: iStockphoto

$4 just to access your own money is unnecessary. Use in-network ATMs or withdraw more strategically. A little planning can prevent those “convenience” charges from piling up like a slow drip from your checking account.

Dining Out Too Often

Credit: iStockphoto

Lunch turns into $18 with tip. Dinner into $40 with drinks. It’s not that anyone’s against eating out—but if it’s routine, not a treat, your budget’s getting eaten too. Cooking at home a few extra nights a week isn’t just healthier, it’s hundreds saved.

Neglecting Budgeting

Credit: iStockphoto

If you don’t know where your money went last month, odds are you weren’t in control of it. Kamel swears by budgeting—not to restrict you, but to free you. You can’t steer your finances if you’re flying blind. Even a basic plan beats no plan.

Skipping Retirement Contributions

Credit: iStockphoto

Waiting to save is like skipping leg day—it catches up to you. Retirement isn’t just for “later.” Missing your 20s or 30s means missing decades of compounding interest. Even small, consistent contributions now grow into something big. Start where you are.

Not Shopping Around

Credit: iStockphoto

New phone, new mattress, new fridge—if you bought it from the first place you looked, you probably overpaid. Comparison shopping is a lost art, but a powerful one. A few extra clicks or calls can save you hundreds. Laziness is expensive.

Falling for Flash Sales

Credit: iStockphoto

“Ends at midnight!” “Only three left!” If your inbox screams urgency, it’s not a deal—it’s a trap. A great way to go about it is that if you wouldn’t buy it at full price, don’t buy it at 30% off. The smartest way to save is to skip stuff you didn’t plan to buy.