Small Habit Changes That Can Drastically Cut Your Grocery Bill

Anyone who shops for food knows how fast the costs add up. It’s not always about big splurges either; the small, everyday choices can drain a budget. The good news is that you don’t have to overhaul your lifestyle to notice a difference. A few simple shifts in how you shop and use what you already have can take the pressure off, while still letting you enjoy the meals you like.

Master the Art of Meal Planning

Credit: pexels

Ever noticed how a midweek “quick stop” at the store often turns into an expensive trip? Planning meals on Sunday prevents that trap. Families who map out their weekly menu spend up to 25% less. Ingredients get used fully, and forgotten produce stops rotting in the fridge. Just 30 minutes of planning sets the tone for a whole week of savings.

Shop Your Kitchen First

Credit: pexels

Before heading to the store, take a quick look at what you already have. That half-box of pasta or bag of beans in the back of the pantry can turn into dinner if you use it up instead of buying more. Checking your shelves first keeps you from buying duplicates and makes it easier to stretch what you’ve already paid for.

Switch to Cash at Checkout

Credit: Canva

Studies show shoppers hand over 12–15% less when using cash. The act of counting out bills makes every purchase feel more real. Keeping money in a grocery-only envelope ensures the budget stays intact. For those tempted by impulse buys, this trick is a built-in barrier. Once the cash is gone, so is the ability to overspend.

Track Prices Like a Pro

Credit: Canva

Sales aren’t always what they look like. If you keep a simple list of what your regular items usually cost, you’ll start to notice when a discount is actually worth it. Over time, patterns appear: maybe chicken drops every few weeks or cereal cycles through sales each month. Knowing the real price makes it easier to stock up when the deal is genuine.

Time Trips Strategically

Credit: Imágenes de unaihuizi

Some days really are better for grocery shopping. Many stores restock midweek and mark down items that need to sell quickly, so shopping later in the week can mean better prices and fresher options. The aisles are also quieter, which makes it easier to focus on what you came for instead of picking up extras you don’t need.

Focus on Unit Prices

Credit: Getty Images

Bigger packages don’t always mean better value. The small label showing cost per ounce or pound is the quickest way to compare brands and sizes. Store brands often come out cheaper, but you only see that when you check the unit price. Once you get in the habit, spotting the real deal becomes automatic.

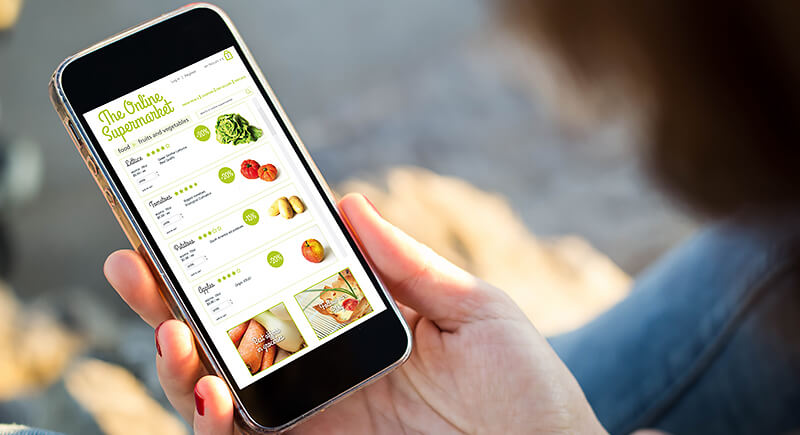

Make the Most of Grocery Apps

Credit: iStockphoto

Shoppers can trim 5–15% from their bill without lifting scissors or collecting flyers. Store apps bring weekly specials, personalized deals, and manufacturer coupons together in one spot. The best part is that discounts apply automatically at checkout—no need for paper. A few minutes of browsing before heading out makes technology the simplest partner for consistent grocery savings.

Double Down With Loyalty Programs

Credit: Getty Images

Rewards programs may not look exciting at first glance, but combining them with a credit card that offers grocery perks adds up fast. This pairing returns 3–8% on purchases with no extra steps. The savings build, month after month, until hundreds of dollars have been earned back by year’s end.

Cook More Whole Foods

Credit: pexels

That jar of pasta sauce is quick, but making your own with a few basic ingredients usually costs less and gives you more to work with. Cooking from whole foods often means fresher flavor, bigger portions, and leftovers you can turn into another meal.

Choose Seasonal Produce

Credit: pexels

What’s the easiest way to cut the cost of fruits and vegetables? Buy what’s in season. When produce is plentiful, prices fall by about 30% and flavor improves. This habit keeps meals balanced, saves money, and makes every bite taste the way it should.

Transform Leftovers Into New Meals

Credit: pexels

Families that rework leftovers into new dishes often save about $50 each month. A roasted chicken might become tacos one night, soup the next, or even a topping for pasta. This approach reduces waste and stretches every dollar spent on groceries.

Explore the Bulk Bins

Credit: iStockphoto

Bulk sections are a low-risk way to stock up or try something new. Staples like rice, beans, and nuts often cost less without the packaging, and you can scoop only what you need. It’s an easy way to cut waste, free up space at home, and experiment with ingredients without overspending.

Shop Less Frequently

Credit: iStockphoto

Every extra visit to the grocery store increases the chance of impulse buys. Shoppers who cut back to once a month have reported slashing their bills nearly in half. Even less drastic changes, like reducing from three trips a week to one or two, make a noticeable dent in spending. Fewer store runs mean fewer temptations and more control over the budget.

Cut Back on Meat Purchases

Credit: Canva

A pound of beans costs pennies compared to ground beef, yet both can anchor a filling meal. Reducing meat just a few times a week frees up a noticeable chunk of the grocery budget. Many families adopt a “Meatless Monday” routine and stick with it once they see the savings. Beyond finances, the swap broadens the menu and introduces new, protein-rich options.

Bring a Calculator to the Store

Credit: iStockphoto

Keeping a running tally while shopping can be eye-opening. Using a calculator or phone to track every item as it goes into the cart makes it harder to overshoot the budget. It also forces quick decisions: do you really need that extra snack, or would it push you over the limit? This habit builds awareness in real time and makes checkout totals far less surprising.