14 Smart Ways to Save Money Without Sacrificing Anything

Trying to save money can feel like chasing your own tail, especially when prices keep jumping and your paycheck doesn’t. But the truth is, a lot of money-saving hacks actually work if you give them a shot. Here are some strategies that can help you hold onto more of your cash.

Buy Generic Brands

Credit: ASphotostudio

Don’t pay for the label. Consumer Reports found that store brands often use the same suppliers as name brands. A can of generic green beans with the same ingredients can cost 50% less than the branded one. Pantry staples and cleaning products are easy swaps. Over a year, those savings stack up.

Automate Your Savings

Credit: Getty Images

Setting up automatic transfers from checking to savings after payday stops you from spending money you don’t see. A Bank of America survey showed that people who automate their savings save 40% more on average. Even $20 a week adds up to over $1,000 in a year.

Use Your Library Card

Credit: Getty Images

The American Library Association says the average household can save over $1,000 a year by borrowing books, movies, games, and even tools. Yep, that little piece of plastic is pure gold. Libraries also offer free passes to museums, resume help, workshops, and more.

Cancel Unused Subscriptions

Credit: Proxima Studio

An app like Rocket Money (formerly Truebill) can scan and cancel sneaky recurring charges. Over half of Americans underestimate how much they spend on subscriptions. You might find you’ve been paying for an old gym membership or a forgotten streaming service you’re no longer using.

Buy Secondhand First

Credit: pexels

Before grabbing anything new, check places like Facebook Marketplace, ThredUP, or Goodwill. Most people only wear 20% of their wardrobe regularly, so you’re likely to find near-new stuff at a quarter of the price. Some secondhand sites even offer return policies.

Cut Dryer Sheets For Good

Credit: Canva

Did you know that wool dryer balls cost around $10 but last for approximately 1,000 loads? Compare that to $10 every few months for dryer sheets, which also leave a residue. Dryer balls can reduce drying time by up to 25%, so you’re saving on electricity, too.

Meal Plan Once A Week

Credit: pixelshot

Planning meals in advance significantly reduces food waste and the temptation to order takeout impulsively. The USDA reports that the average family throws away around $1,500 in food annually. Just by planning five dinners, you can cut food waste in half and shave down grocery bills by about 20%.

Use Cashback Apps

Credit: Kaspars Grinvalds

Apps like Ibotta and Rakuten pay real cash, not points. Every time you shop, you’re getting back a slice of your purchase. The average Ibotta user earns around $130 a year. To keep the process easy, simply link your accounts and activate offers before shopping.

Set A 24-Hour Rule For Spending

Credit: Canva

Impulse buys are budget killers. A study from CNBC found that Americans spend around $314 every month on spontaneous purchases. Waiting just one day before buying non-essentials slashes that in half. If you still want it tomorrow, that’s fine. But if not, at least your wallet wins.

Negotiate Your Bills

Credit: Pressmaster

Most people never think to call their service providers, but companies like Comcast or AT&T often have unadvertised discounts. Just mention a competitor’s deal or say you’re thinking of switching. According to Consumer Reports, 70% of people who tried this method received a better price.

Use Envelope Budgeting

Credit: pexels

Split your monthly cash into envelopes for each spending category. Once it’s empty, you’re done spending in that area. People who use the envelope method tend to spend 20% less simply by being more aware. It’s tactile and impossible to ignore.

DIY Cleaning Supplies

Credit: atlasstudio

A bottle of store-bought cleaner can cost $5, while a mix of vinegar, water, and baking soda costs under a dollar. The Environmental Working Group even agrees that homemade cleaners are safer, too. Add some essential oil if you want it to have a nicer scent.

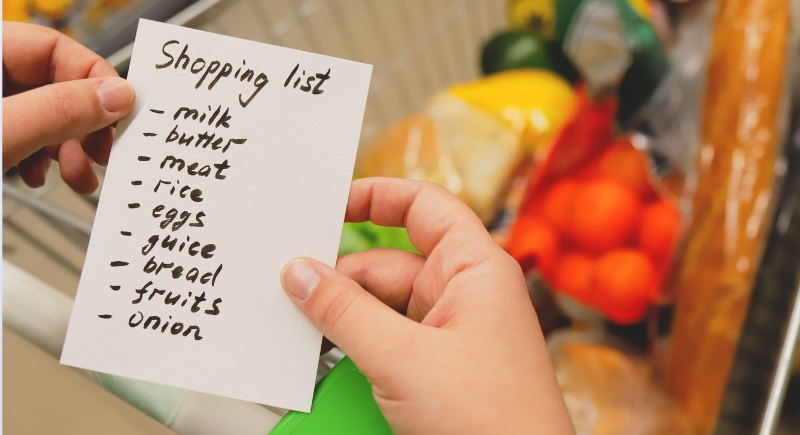

Shop With A List Only

Credit: Getty Images

Impulse shopping increases grocery bills by about 23%, according to a study by Slickdeals. Walking in with a solid list keeps your brain and your budget on track. Stick to the plan, and don’t browse just for fun—it’s how that extra $50 ends up in your cart.

Refinance Student Loans

Credit: Getty Images

If you’ve got decent credit and stable income, refinancing can lower your interest rate and save thousands over time. NerdWallet reports the average borrower saves $259 a month by refinancing. Just be cautious with federal loans, as refinancing converts them into private loans and removes certain protections.

Cut Back On Meat

Credit: Getty Images

Going meatless for even two days a week can lower your grocery bill. USDA data shows meat is one of the most expensive food categories. Swapping it for beans, lentils, or tofu can save a family of four up to $900 a year, without sacrificing protein.