7 Smart Ways to Become Rich on a Regular Salary

Wealth does not usually arrive in one giant leap—it builds slowly through steady, thoughtful moves. Many regular folks have turned everyday salaries into impressive fortunes by sticking to smart habits. Here are seven smart ways you can do it, too.

Harnessing Time

Credit: pexels

Small moves made early can pack a serious punch later on. Someone who kicks off their investing journey at 24 by setting aside $500 a month could build a nest egg topping $1.5 million by 65.

Holding Onto Discipline

Credit: pexels

Growing wealth on a regular paycheck comes down to a game plan. Successful investors set clear goals, stick to steady investments, and tune out market noise. Tools like automatic investment plans make it easier to stay on track by turning patience, strategy, and consistency into serious financial muscle over time.

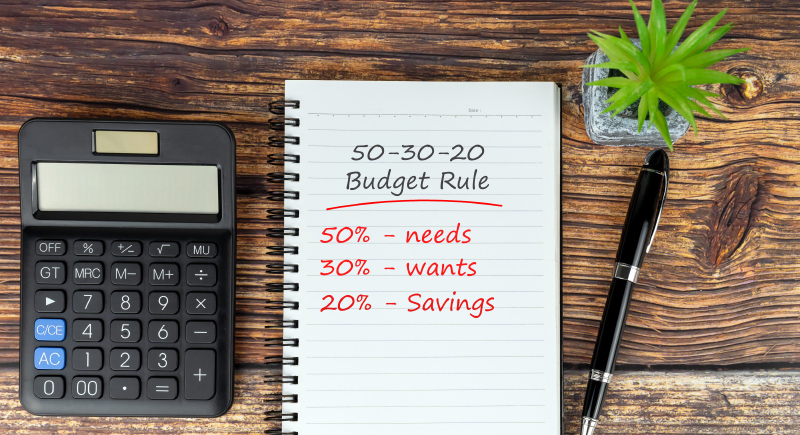

Making Savings a Priority

Credit: iStockphoto

Treating your savings like the most important bill of the month flips the whole money game in your favor. Instead of waiting to see what’s left over at the end of the month, carving out savings first keeps you in control. The 50-30-20 rule—covering needs, enjoying wants, and growing savings—has paved the way for countless self-made millionaires.

Sticking to Used Cars

Credit: pexels

Stretching every mile out of a reliable used car ranks among the smartest financial moves you can make. New cars lose about 60% of their value in just five years, while a dependable pre-owned ride skips that steep slide and keeps more cash in your pocket. Lower insurance premiums and cheaper registration fees sweeten the deal.

Living Richer for Less

Credit: pexels

Living large does not always mean spending big. Warren Buffett, a prominent figure in the world of investing, still calls the modest house he bought in 1958 home. Small choices—like swapping takeout for home-cooked meals, scouting out discounts, and cutting off subscription dead weight—can snowball into serious savings. Over time, those everyday decisions build the foundation for real financial freedom.

Creating Extra Income Streams

Credit: pexels

Counting on one paycheck is a bit like walking a plank—steady until a sudden gust hits. Building extra income streams gives you a sturdy ship instead. Turning skills into consulting gigs, launching an online course, investing in dividend stocks, or growing a YouTube audience can pay off big time.

Unlocking Better Financial Opportunities

Credit: pixabay

A strong credit score is like having VIP access to better financial deals. It helps lock in lower interest rates on loans and credit cards. Timely bill payments mark up 35% of your FICO® Score, while keeping credit balances under 30% keeps lenders smiling.

Thinking Like the Wealthy

Credit: pexels

Seeing the world through a wealth-building lens changes everything. Instead of stressing over every dollar, people with an abundance mindset believe opportunities are everywhere and trust their ability to grow their finances. They aim for long-term wins, invest in their own skills, and are not afraid to take smart risks.

Using Borrowing Power Smartly

Credit: pixabay

Borrowing money does not always have to be a setback—it can actually be a smart move when used wisely. Good debt is all about financing things that grow in value or boost your earning power, like a mortgage on a home or student loans for a degree that opens better career doors. The key is keeping payments under control.

Navigating Funds and REITs for Growth

Credit: pixabay

Stretching a regular paycheck into real wealth is less about luck and more about picking the right lanes to cruise in. Index funds, especially the S&P 500, have quietly rewarded patient investors with about 10% annual returns over the decades. REITs throw another layer of opportunity into the mix by offering solid dividends without the headaches of becoming a landlord.

Getting a Financial Guide

Credit: pexels

A good financial advisor helps build a game plan that fits your goals, income, and dreams for the future. They are also great at keeping emotions in check when markets get bumpy. As life throws curveballs—new jobs, bigger families, surprise expenses—advisors adjust your strategy to keep you moving toward real financial freedom.

Consistent Investing In the Future

Credit: iStockphoto

Consistency beats chaos, especially when it comes to investing. Consistently setting aside part of your paycheck for investments takes the pressure off trying to time the market and leans into a smart trick called dollar-cost averaging. Buying a little at a time smooths out the highs and lows and builds momentum you barely notice—until it snowballs.

Boosting Your Earning Power

Credit: iStockphoto

Warren Buffett said it best: investing in yourself is the greatest move you can make. Leveling up with skills like data analysis, project management, or software development can fast-track your career and open up bigger financial opportunities. Strengthening soft skills like leadership and communication can be just as valuable.

Taking Calculated Risks

Credit: pexels

Michael Bloomberg took his $10 million severance and bet on the idea that financial pros needed faster data—an idea that turned into Bloomberg LP. Smart, calculated risks—anchored by research and big-picture thinking—have a way of turning bold visions into massive wins.