10 Proven Tips to Help Lower Your Monthly Mortgage Payment

When a big portion of your paycheck disappears into your mortgage, it’s hard to make space for anything else. But the amount you send your lender each month isn’t as fixed as it might seem. There are strategies that can lower what you owe without sacrificing your long-term financial goals.

If your mortgage feels too heavy, these proven methods are worth considering.

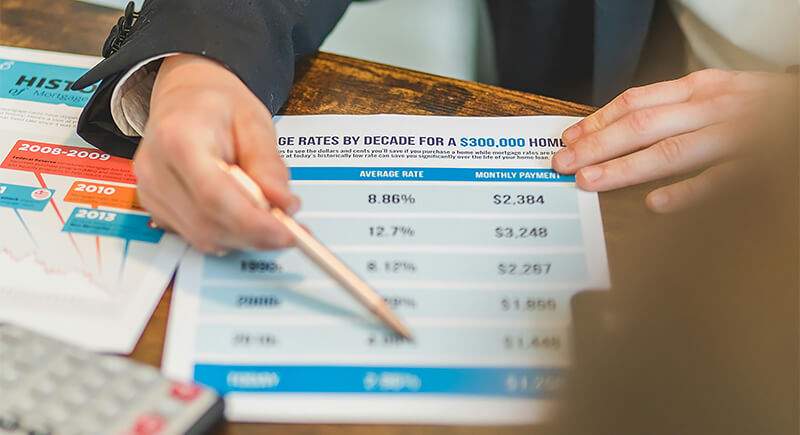

Refinance for a Lower Interest Rate

Credit: pexels

A lower interest rate can shave hundreds off your monthly payment. Refinancing is most effective if your current rate is above 6% and you plan to stay in the home for several years. Keep in mind that closing costs apply, so the long-term savings should justify the upfront expense.

Recast Your Mortgage with a Lump-Sum Payment

Credit: pexels

If you’ve put a large chunk of money toward your mortgage, ask your lender about a recast. It doesn’t change your interest rate or loan length, but it recalculates your monthly payment based on the new, smaller balance. It’s often a cheap way to lower what you owe each month, though not every lender offers it, so check if yours does.

Eliminate Private Mortgage Insurance (PMI)

Credit: Canva

If you’ve built at least 20% equity in your home, you might qualify to remove PMI. This extra monthly charge often adds up. To eliminate it, you will need to contact your lender and show a solid payment record. You might also have to submit a new appraisal to confirm your home’s current value.

Appeal an Overassessed Property Tax Value

Credit: Getty Images

When local tax assessors overestimate your home’s value, your monthly payment can rise unfairly. If property values have dropped or your assessment seems inflated, file an appeal. You’ll need documentation to support your case, and success depends on your county’s process, but the savings can be worthwhile.

Shop Around for Lower Homeowners Insurance

Credit: Getty Images

Escrow payments often include homeowners’ insurance, and switching providers could lower that part of your bill. Compare quotes annually, ask about bundling discounts, and review your coverage to ensure you’re not over-insured. Even small changes to your premium can lower your monthly mortgage obligation.

Modify Your Loan Terms Due to Hardship

Credit: Getty Images

Sometimes, a major life event, such as job loss, illness, or a reduction in income, can make payments unmanageable. When that happens, contact your lender. A loan modification can lower your monthly payment by changing your rate, extending the term, or adjusting the balance. It takes some paperwork and usually a trial period, but it can be a lifeline that helps you keep your home.

Make Extra Payments Toward Principal

Credit: Canva

Making extra payments on your mortgage can cut years off your loan and save you thousands in interest. Even small boosts—like rounding up your payment or using a tax refund—can make a difference. Just be sure to tell your lender that the extra amount should go toward the principal, not toward future payments.

Switch to Biweekly Mortgage Payments

Credit: iStockphoto

Instead of one full payment each month, split it into half-payments every two weeks. You’ll end up making 13 full payments a year instead of 12. That extra payment helps reduce your balance faster and shortens the loan term. It’s a steady way to reduce interest without needing a big one-time investment.

Refinance Into a Longer-Term Loan

Credit: Canva

Refinancing into a 30-year loan spreads payments over a longer period if you’re struggling with a short-term loan like a 15-year mortgage. This lowers monthly costs but increases overall interest. It’s a tradeoff that can free up cash flow when budgets are tight.

Convert an FHA Loan to a Conventional One

Credit: iStockphoto

FHA loans often come with long-term mortgage insurance. If your credit and finances have improved, refinancing into a conventional loan can help alleviate that burden. Once you hit 20% equity in your new loan, you can request to drop PMI and reduce your overall housing costs.