Simple Tricks to Ease Your Mind if You Can’t Stop Thinking About Money

If your thoughts keep circling back to bills, savings, or what’s left in your account, you’re not the only one. Money stress weighs on nearly everyone at some point, and for many, it can feel constant. But that doesn’t mean you’re stuck with it. With a few small shifts in focus and habit, you can start to quiet the noise, think more clearly, and feel steadier about your finances.

Schedule Worry Time

Credit: Getty Images

Instead of letting money thoughts interrupt your day, dedicate 15 minutes each week to focus on them. Write down every concern, sort what you can control, and leave the rest for later. When your time’s up, close the notebook and move on. This helps you confine worry to a small window instead of letting it consume your week.

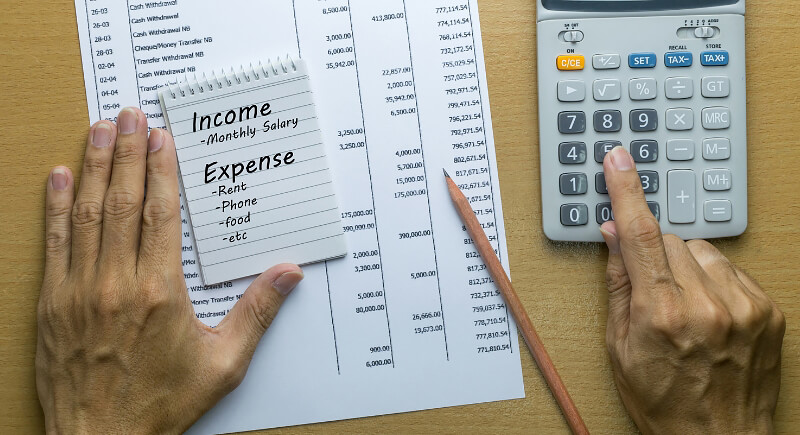

Build a Real-Life Budget, Not a Wish List

Credit: Canva

A good budget starts with what’s real, not what you wish you earned or spent. List your actual income, track what goes out, and look at the pattern. Once you see where your money really moves, it’s easier to make choices that stick. Clarity replaces guesswork, and the numbers start to tell a story you can actually live with.

Create an Emergency Fund Buffer

Credit: Getty Images

Few things ease financial stress like knowing you’ve got a safety net. Set aside money for the things you can’t plan: car repairs, medical bills, or a sudden job loss. The goal is to build a fund that covers three to six months of expenses, so life’s surprises feel like bumps in the road instead of full stops.

Tackle High-Interest Debt First

Credit: Canva

Start by focusing on high-interest balances, like credit cards. Paying those off not only saves money but also brings relief from that “never-ending” feeling. Small, steady progress on one account at a time makes stress shrink faster than you’d expect.

Automate What You Can

Credit: Canva

Take the pressure off by putting parts of your money life on autopilot. Set up automatic transfers to savings and autopay for recurring bills. That way, you’re less likely to forget payments or overthink budgeting. Automation replaces worry with consistency.

Track Small Purchases to Find Hidden Drains

Credit: Getty Images

It’s easy to overlook the little things—coffee runs, streaming subscriptions, or late-night delivery fees—but they eat into your budget. Take a week or two to track every small expense. You’ll start spotting habits that cost more than they’re worth, and cutting a few of them can free up money without feeling like a sacrifice.

Use Visual Goals to Stay Motivated

Credit: Getty Images

Abstract goals like “save more” rarely inspire action. Give your goals shape: “I’ll save $1,000 in six months” or “I’ll pay off $300 in credit card debt by summer.” Keep these visuals on a board or app. Tracking your wins makes the process satisfying instead of stressful.

Expand the Gap Between Income and Expenses

Credit: Getty Images

The more distance between what you make and what you spend, the calmer you’ll feel. Try cutting one recurring cost or boosting income through a side gig. Even minor adjustments widen your financial comfort zone and shrink stress.

Review Your Finances Regularly

Credit: Canva

Money stress often grows when you avoid it. Take a few minutes each week or month to look over your bills, savings, and goals. The more often you check in, the fewer surprises you’ll face, and the easier it becomes to feel steady about your finances.

Talk About Money With Someone

Credit: Getty Images

Money worries tend to multiply when you keep them to yourself. Talking things through with someone you trust can take the edge off. Whether it’s a friend, family member, or advisor, sharing your concerns helps turn scattered thoughts into a plan you can actually act on.

Practice Relaxation Techniques

Credit: Getty Images

When money anxiety hits, pause for a simple breathing exercise. The 4-7-8 method (inhale four seconds, hold for seven, exhale for eight) can calm your body’s stress response. Relaxation resets your mindset, helping you make smarter, calmer financial choices.

Keep Perspective: Money Isn’t Everything

Credit: Canva

Financial stability matters, but happiness doesn’t hinge entirely on dollars. Focusing on what’s going right, like health, safety, and loved ones, grounds your outlook. Perspective helps reframe money from a constant worry into one piece of a fuller, more balanced life.

Diversify Your Income

Credit: Canva

Relying on one paycheck can make you feel vulnerable. Building a small side income or freelance stream reduces that pressure. Whether it’s tutoring, selling online, or part-time work, extra income adds security and quiets the “what if” worries.

Seek Professional Help When Needed

Credit: Canva

If money stress keeps you up at night or affects your mood, reach out for guidance. Financial advisors can help with strategy, and therapists can tackle the emotional side. Getting help means you’re taking action.

Celebrate Small Wins

Credit: Getty Images

Remember that progress deserves recognition. Every dollar saved or debt payment made is worth celebrating. Treat yourself to something small when you hit a milestone. Rewarding positive behavior builds motivation and makes the journey feel lighter and more rewarding.